Navigating your way through the stock market can seem like a daunting task. With its jargon filled language, volatile markets, and overwhelming choices of securities to invest in, the stock market can appear completely inaccessible to anyone without a financial background. But behind all these confusing concepts lies an accessible path to success with the right knowledge and strategy, investing in stocks is within reach for everyone.

In this blog post series, we'll explore everything you need to know about how to buy stocks correctly; from understanding terminology and analyzing company fundamentals, all the way up to picking great stock investments for yourself or your portfolio. So don't be intimidated by learning some key points along the journey; you'll soon become confident enough to start burying those mysteries of Wall Street yourself!

Understand the Basics of the Stock Market:

Investing in the stock market is a powerful tool to grow your personal wealth and safeguard your financial future. Although it may seem intimidating to newcomers, understanding the basics of the stock market is essential before making any investment decisions.

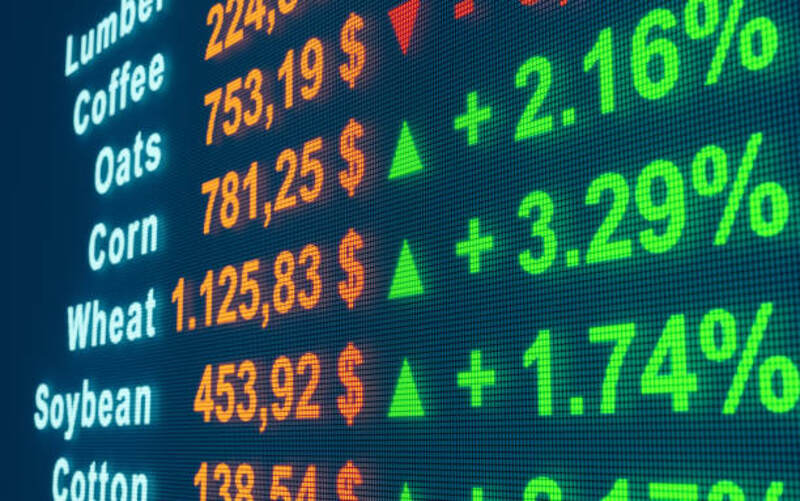

But fear not, it is not as complicated as it may seem. In its simplest form, a stock is a small piece of ownership in a company. When you buy a stock, you are essentially buying a share of that company's profits and losses. Trading works by investors buying and selling these shares, which can fluctuate in value based on many factors, such as:

- Company performance

- Market trends

- Global events

By grasping the fundamental concepts of the stock market, you can unlock a world of investment opportunities and maximize your financial returns.

Research different stocks:

Investing in stocks can be a great way to grow your wealth, but it's important to do your research first. Researching different stocks can help you understand which companies are worth investing in.

By looking at a company's financial statements, you can learn about their revenue, expenses, and profits. You can also research a company's industry, competitors, and management team to get a better understanding of their potential for growth.

With this information, you can make informed investment decisions that can help you achieve your financial goals. So, take the time to research different stocks and build a diversified portfolio that can help you maximize your returns.

Determine your investing goals and time frame for investment:

Investing can be a daunting task, but determining your investing goals and time frame can help make it a lot clearer. Ask yourself,

- What are you trying to accomplish through investing?

- Are you looking to save for retirement, buy a new home, or simply grow your wealth?

Once you have a clear target in mind, you can determine the appropriate time frame for your investment.

- Short term goals might require more conservative investments, such as bonds or money market funds,

- while long term goals may allow for more aggressive investments, such as stocks.

Whatever your goals may be, it's important to have a solid understanding of your time frame and investment objectives before making any decisions.

Explore online brokerage accounts, their fees and services:

In today's fast paced world, people are looking for convenient ways to grow their wealth. Enter online brokerage accounts, the answer to almost every investment dream. With a simple click, you can open an account and start investing in stocks, bonds, mutual funds, and more.

However, before diving into the world of online investing, it is essential to research fees and services of various online brokerages to find the best one for you. With so many available options, it might be challenging to discern which suits your needs best.

But don't worry, with careful consideration, you can find an online brokerage that aligns with your investment goals and helps make your financial dreams a reality.

Set up an account with the broker of your choice and fund it:

Setting up an account with a broker of your choice may seem like a daunting task, but it's actually quite straightforward. Once you've done your research and found a reputable broker, simply follow their instructions to create your account.

Most brokers will require some personal information and identification verification before allowing you to fund your account. Once your account is set up, funding it is easy and can be done through a variety of methods.

Some brokers allow bank transfers or credit card deposits, while others accept transfers from popular payment platforms like PayPal. The important thing is to make sure you have enough funds in your account to start making trades and managing your investments. So take the plunge, set up your account, and watch your financial future take shape.

Decide how much you want to invest in each company's stocks:

Investing in stocks can be a daunting task, but deciding how much to invest in each company's stocks is a crucial step in the process. A helpful tip when making this decision is to thoroughly research the company and examine its financial history.

It is also important to consider your own personal financial goals and risk tolerance. Allocating funds appropriately among different companies can help diversify your portfolio and minimize risk.

Ultimately, the decision of how much to invest in each company's stocks should be made carefully and thoughtfully, taking into account various factors that impact the stock market.

Conclusion:

Investing in the stock market can be rewarding but it is important to stay informed. It is critical to get familiar with the basics, understand what stocks are and learn how the trading process works before you start investing. Research different companies and their stocks, determine your investment goals, select a broker and set up an account, and decide how much to invest in each company's stocks.

FAQs:

What is a stock?

A stock is a small piece of ownership in a company. When you buy a stock, you are essentially buying a share of that company's profits and losses.

How can I learn the basics of the stock market?

You can start by reading up on stock market basics, such as what stocks are and how trading works. You can also find helpful information on financial websites or by talking to a financial advisor.

How do I choose an online broker?

Research different online brokers to find the one that best suits your needs and investment goals. Look at their fees, services offered, account minimums, and customer support before making a decision.